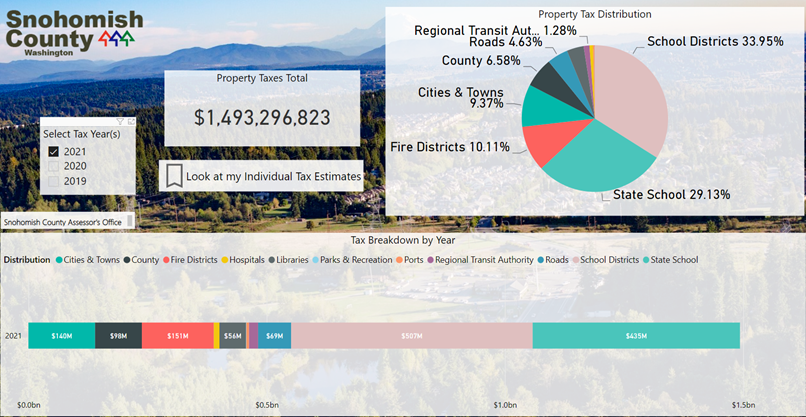

snohomish property tax rate

Our mailing address is. Property class Market value Assessment value Total tax rate Property tax.

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

There are three primary phases in taxing property ie devising levy rates assigning property market worth and receiving receipts.

. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Snohomish WA 98291-1589 Utility Payments PO. The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate of 089 of property value.

Receipts are then dispensed to associated taxing units via formula. Accounts with delinquent taxes must first be approved by the Snohomish County Treasurers Office. Please call 425-388-3606 if you would like to make payments on.

Property tax payments are due by April 30 and October 31. Single Family Residence - Detached. Ad Find Snohomish Property Tax Info From 2022.

Types of county reports include. MS 510 Everett WA 98201-4046 Ph. The assessed value of your property is multiplied by the tax rate necessary in your levy area to produce your fair share of the total levied tax by these jurisdictions.

Prior to I-747 the limit was 106 per Referendum 47. For a reasonable fee they will accept monthly payments and pay your tax bills when due. Whether you are already a resident or just considering moving to Snohomish County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

If the tax due is more than 50 half of the amount due may be paid by April 30 and the balance by October 31. Contact Evergreen Note Servicing online by clicking here or by phone at 253-848-5678. Search in Snohomish County Now.

The Department of Revenue oversees the administration of property taxes at state and local levels. Individual Program Review of a single area of property. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related.

Additional tax payment options including online payment options are viewable here. Snohomish WA 98291-1589 Utility Payments PO. Taxes Tax Statistics For rate questions visit Washington State Department of Revenue or call 800-547-7706.

Check the Current Taxes Value Assessments More. Box 1589 Snohomish WA 98291-1589. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

Levy Division Email the Levy Division 3000 Rockefeller Ave. Taxing authorities include Snohomish county governments and numerous special districts like public schools. Credit card payments can be made over the phone by calling 833-440-3332 or by visiting our payment site here.

Payment of Property Taxes. Property taxes have increased in recent. Single Family Residence - Detached.

39 rows The countys average effective tax rate is 119. The regular property tax levy of a taxing district is limited to 101 of the highest levy since 1985 plus amounts attributable to new construction within the boundaries of the district increases due to newly constructed wind turbines andor annexations to the district. Regional Transit Authority RTA No.

Learn all about Snohomish County real estate tax. For comparison the median home value in Snohomish County is 33860000. If the amount of tax due is 50 or less full payment is due by April 30.

Explore important tax information of Snohomish. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Snohomish County. In our oversight role we conduct reviews of county processes and procedures to ensure compliance with state statutes and regulations.

Single Family Residence - Detached. Snohomish County Government 3000 Rockefeller Avenue Everett WA. Public Transportation Benefit Area PTBA Snohomish PTBA.

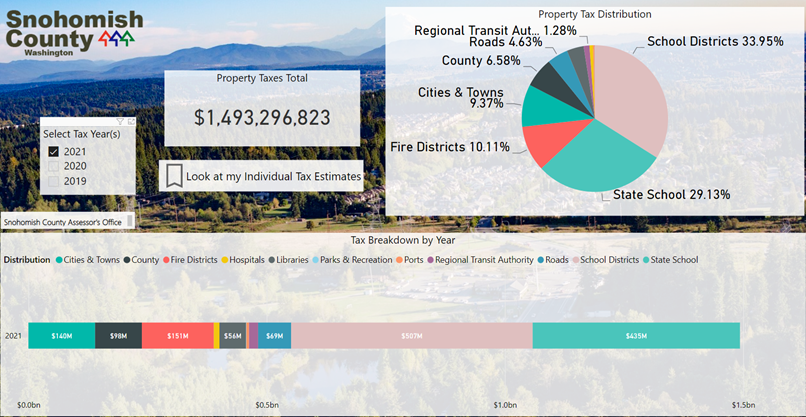

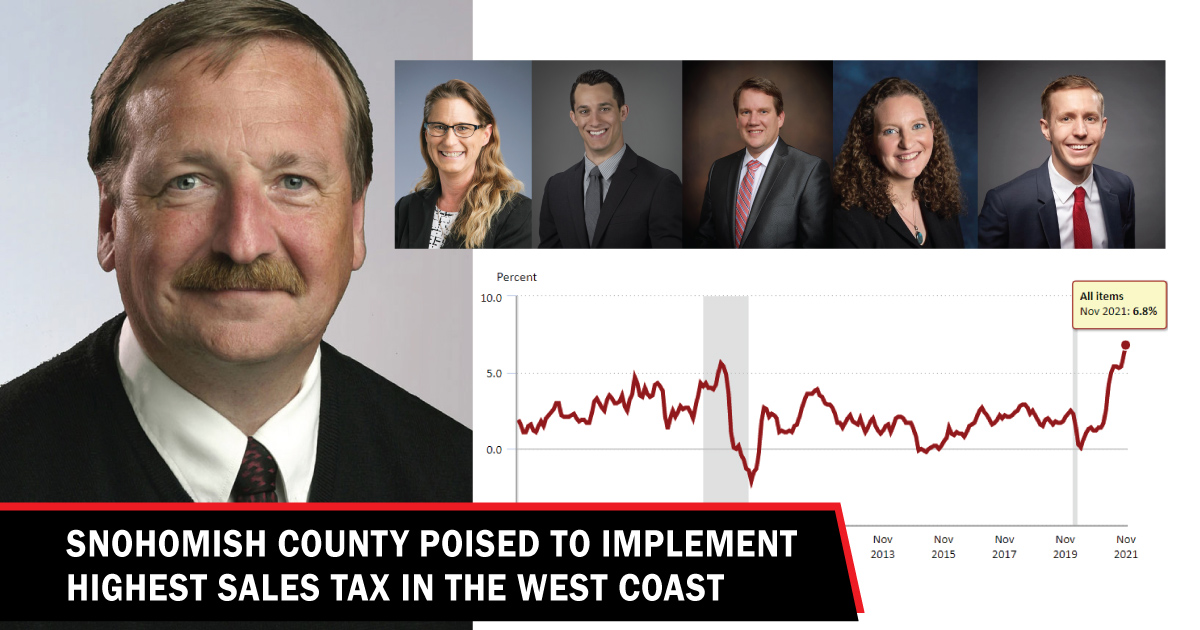

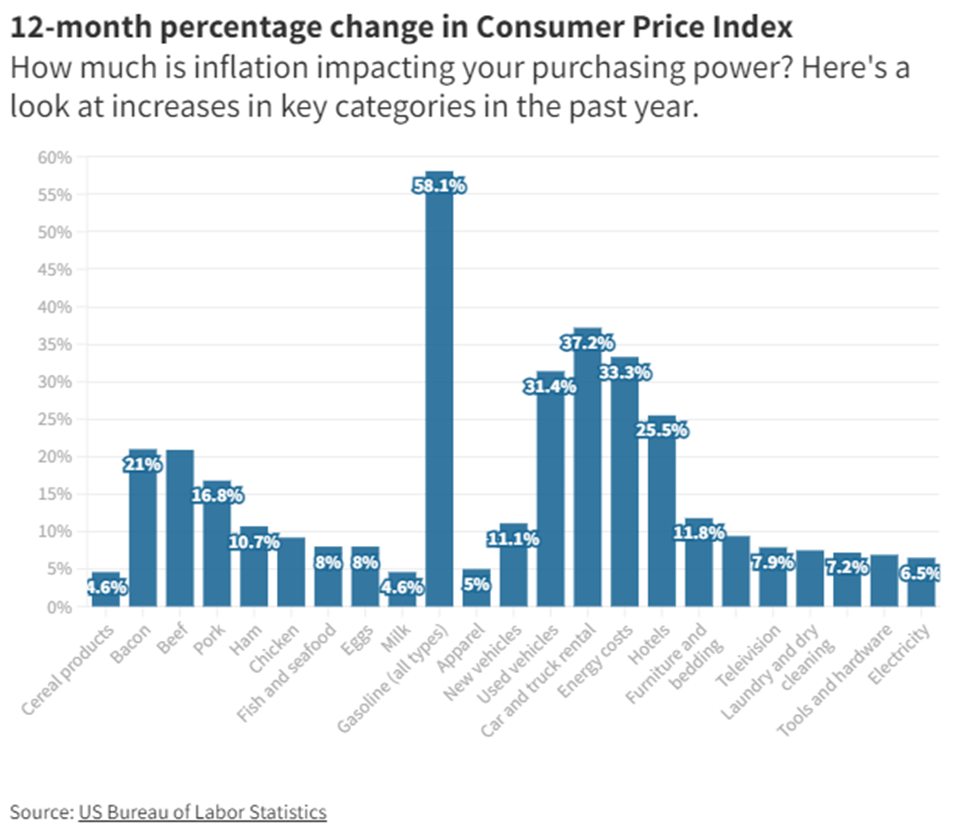

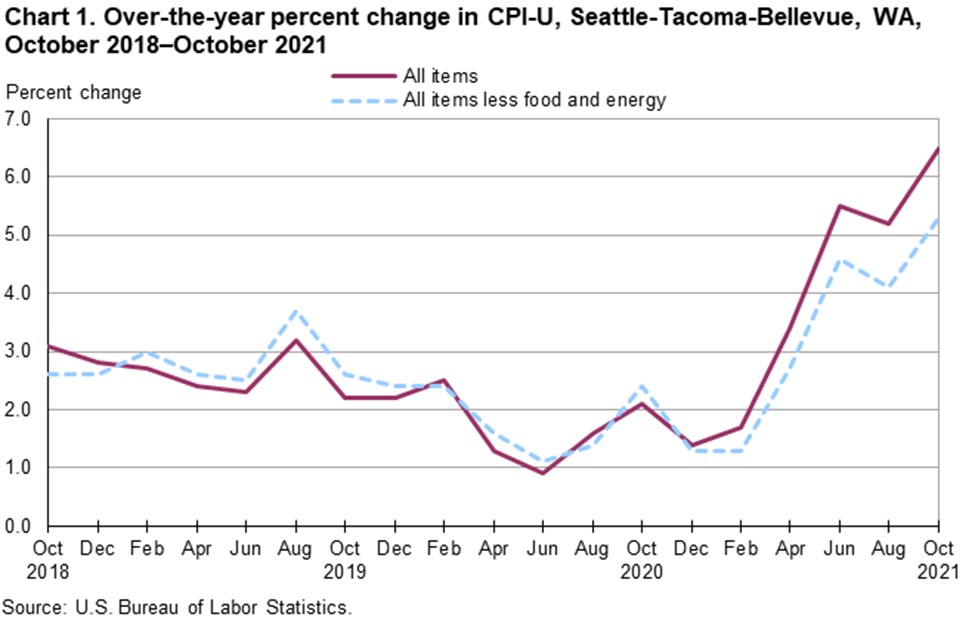

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

How To Calculate Property Tax In Snohomish County Washington Destinationpackwood Com

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Graduated Real Estate Tax Reet For Snohomish County

Property Values Are On The Rise In Snohomish County Youtube

Real Estate Tips Home Buying Realtor Florida

Money Is Everywhere Over 50 Ways To Make Quick Extra Income Updated In 2019

News Flash Snohomish County Wa Civicengage

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

News Flash Snohomish County Wa Civicengage

Snohomish County Home Values Soar In Latest Assessment Heraldnet Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

About Snohomish County Snohomish County Wa Official Website

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Snohomish County Property Values Increasing Rapidly King5 Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times